This comprehensive guide simplifies the process of completing IRS Form 8283, helping you accurately claim deductions for your non-cash charitable contributions. Understanding this form is crucial for maximizing your tax benefits while ensuring compliance with IRS regulations.

When Do I Need Form 8283?

IRS Form 8283 is required when you donate non-cash items valued at over $500 to a qualified charitable organization. This includes a wide range of items, from vehicles and real estate to artwork and clothing. Failing to use Form 8283 when necessary can result in the rejection of your deduction.

Gathering the Necessary Information: Documentation is Key

Before you begin completing Form 8283, gather all necessary documentation. The specific requirements depend on the type and value of your donation.

1. Everyday Items (Clothing, Household Goods): For items under $500, a simple receipt might suffice. For higher-value donations, maintain detailed records describing the items and their estimated fair market value.

2. Vehicles: You'll need the title transferring ownership to the charity and a confirmation letter from the charity acknowledging receipt.

3. High-Value Items (Real Estate, Art, Antiques): A professional appraisal is mandatory for items exceeding $5,000. This appraisal must be performed by a qualified appraiser specializing in the type of donated property. The appraisal should detail the item's description and fair market value.

Did you know that a poorly documented donation can lead to your deduction being denied? Proper record-keeping is essential for a smooth tax filing process.

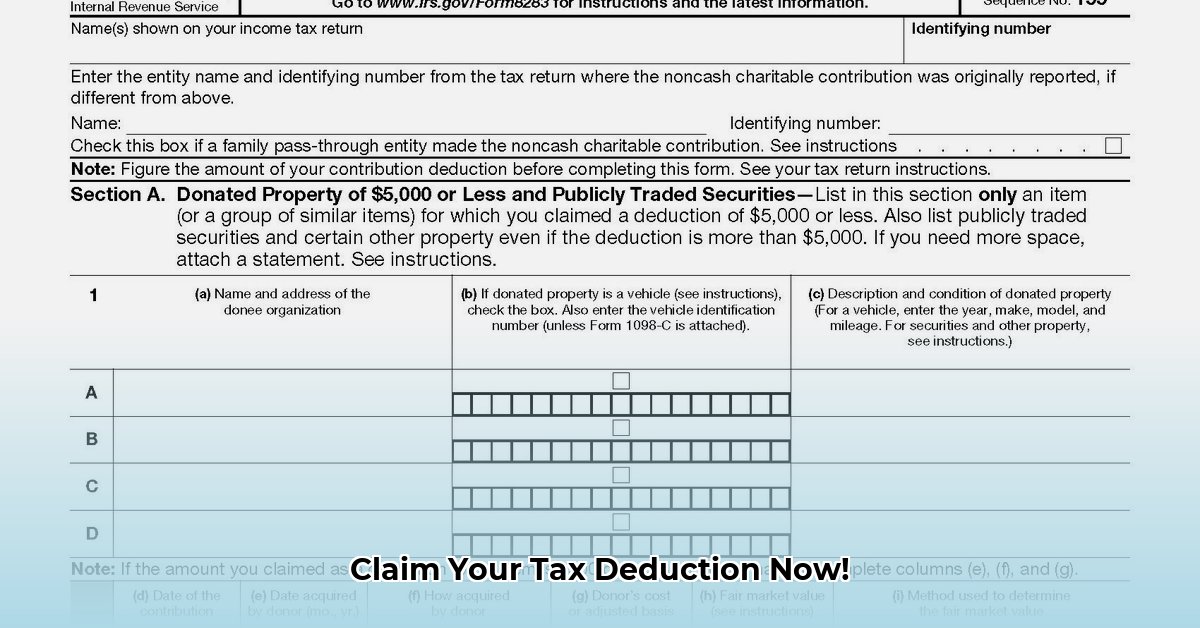

Completing Form 8283: A Step-by-Step Approach

Form 8283 is divided into sections. Let's break down each part:

1. Part I: Your Information and the Charity's Information: Enter your personal details and the charity's name and tax identification number. Double-check for accuracy to avoid delays or rejection.

2. Part II: Description of Noncash Contribution: Provide a detailed description of the donated item, including the date of acquisition and the date of donation. The more detail you provide, the better.

3. Part III: Capital Gain Property: This section applies if your donation might generate a capital gain. If you're unsure, seek professional tax advice.

4. Part IV: Qualified Appraisal Summary: If required, include details from your professional appraisal, including the appraiser's qualifications and the appraisal report itself.

5. Part V: Additional Information: Use this section for any further explanations or details not covered elsewhere on the form. Remember, clear communication is key to avoiding confusion.

How many times have you heard of a tax return delayed due to incomplete information? Taking your time to accurately fill out Form 8283 is an investment in a stress-free tax season.

Valuation of Noncash Contributions: Determining Fair Market Value

Accurately determining the fair market value (FMV) of your donation is critical. FMV is the price a willing buyer would pay a willing seller in an open market. For items under $500, a reasonable estimate is acceptable. However, for higher-value items, a professional appraisal is not only recommended but often required.

Choosing a qualified appraiser is crucial. Verify their credentials and experience to ensure the appraisal's reliability. A credible appraisal protects you from potential audit challenges.

What's the single biggest mistake people make when valuing their donations? Overestimating the value! Remember, accurate valuation safeguards your deduction.

Record Keeping: The Importance of Meticulous Documentation

Maintaining detailed records is essential for protecting yourself against potential audits. Keep copies of all relevant documentation, including appraisals, receipts, canceled checks, and communication with the charity. Retain these records for at least three years after filing your tax return.

Potential Problems and Their Solutions

- Overvaluation: Avoid overestimating the value of your donation. Use a qualified appraiser for high-value items.

- Incomplete Documentation: Ensure you have all necessary documentation before filing.

- Errors on the Form: Carefully review your completed Form 8283 for accuracy.

- Ignoring Professional Advice: Seek professional tax advice for complex situations.

Conclusion: Claiming Your Deduction with Confidence

By following this guide, you can confidently complete Form 8283 and claim the tax deductions you deserve for your generous charitable contributions. Remember, careful preparation and accurate documentation are crucial for a smooth tax filing experience. While many find they can complete the form on their own, seeking professional help from a qualified tax advisor can provide peace of mind, particularly with complex donations. Consult a professional if you have any doubts or questions about the process.

Key Takeaways:

- Form 8283 is crucial for non-cash donations over $500.

- Accurate valuation is vital to avoid penalties.

- Professional appraisals are often mandatory for higher-value items.

- Meticulous record-keeping protects you from audits.